tucson sales tax rate 2019

The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87. Authorize a voter-approved sales tax increase of one tenth of a percent 01 to fund the Reid Park Zoo Improvement.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Effective July 01 2003 the tax rate increased to 600.

. The average sales tax rate in Arizona is 7695. Three cities follow with combined rates of 10 percent or higher. You can find more tax rates and allowances for Tucson and Arizona in the 2022 Arizona Tax Tables.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. What is the sales tax rate in Tucson Arizona. The latest sales tax rates for cities starting with A in Arizona AZ state.

Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. Updated Jul 22 2019. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725.

Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the model tax code. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250 city sales tax.

The latest sales tax rate for Tucson AZ. As the result of a Special Election held on November 7 2017 Mayor and Council adopted Ordinance No. Tubac AZ Sales Tax Rate.

Tucson Sales Tax Rates for 2022. What is the sales tax rate in South Tucson Arizona. The December 2020 total local sales tax rate was also 8700.

If you need to buy a big-ticket item say a new refrigerator you could save some money by buying where the sales tax is lower. Wayfair Inc affect Arizona. The Tucson sales tax rate is.

This rate includes any state county city and local sales taxes. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Effective July 01 2009 the per room per night surcharge will be 2.

19-01 to increase the following tax rates. The minimum combined 2022 sales tax rate for South Tucson Arizona is. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

Method to calculate New Tucson sales tax in 2021. The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those same business activities. The Arizona sales tax rate is currently.

A 1500 refrigerator purchased in Marana where the sales. 2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax deduction.

South Tucson AZ Sales Tax Rate. The sales tax increase is aimed at the business categories because they are currently taxed below the average across all categories of 55 percent. The South Tucson City Council is considering raising sales taxes by half a percent on utilities communications and retail sales to sustain an estimated budget deficit of 293000 in 2020.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. The average sales tax rate in Arizona is 7695. Public Utility Additional Communications 105.

Arizona has 511 special sales tax jurisdictions with local sales taxes in. Spring Valley AZ Sales Tax Rate. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. Did South Dakota v. Rates include state county and city taxes.

Maricopa County Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Avondale 320 560 Buckeye 370 560 Carefree 370 560. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. Stanfield AZ Sales.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. This is especially important to note if you are an annual filer as the city tax rate has increased from the return filed for 2017.

The minimum combined 2022 sales tax rate for Tucson Arizona is. The South Tucson sales tax rate is. Method to calculate Tucson sales tax in 2021.

This is the total of state county and city sales tax rates. Average Sales Tax With Local. The County sales tax rate is.

Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. Springerville AZ Sales Tax Rate. Groceries and prescription drugs are exempt from the Arizona sales tax.

Sales Tax Rates Effective April 1 2019 Combined List 2202019 30221 PM. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. The County sales tax rate is.

The Tucson Sales Tax is collected by the merchant on all qualifying sales made within Tucson. This is the total of state county and city sales tax rates. The Arizona sales tax rate is currently.

There are a total of 81 local tax jurisdictions across the state collecting an average local tax of 2433. Did South Dakota v. Groceries are exempt from the Tucson and Arizona state sales taxes.

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Rates In Major Cities Tax Data Tax Foundation

2021 2022 Sources Of Funds And Uses Of Tax Dollars Pima C

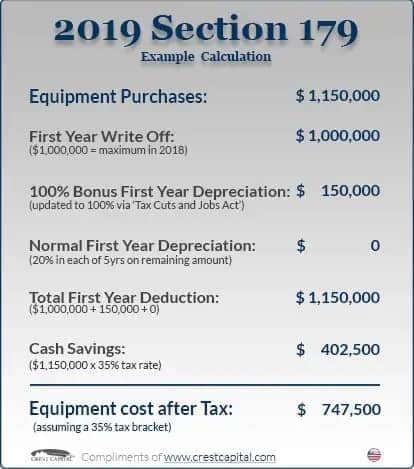

Section 179 Tax Deduction Downtown Ford Sales

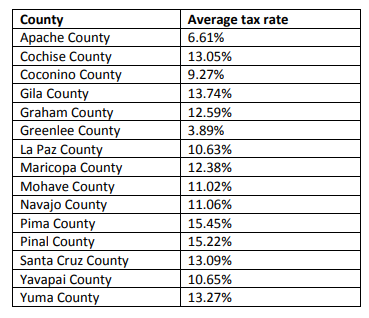

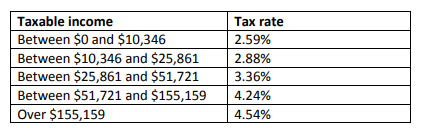

State And Local Taxes In Arizona Lexology

Arizona Sales Tax Rates By City County 2022

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

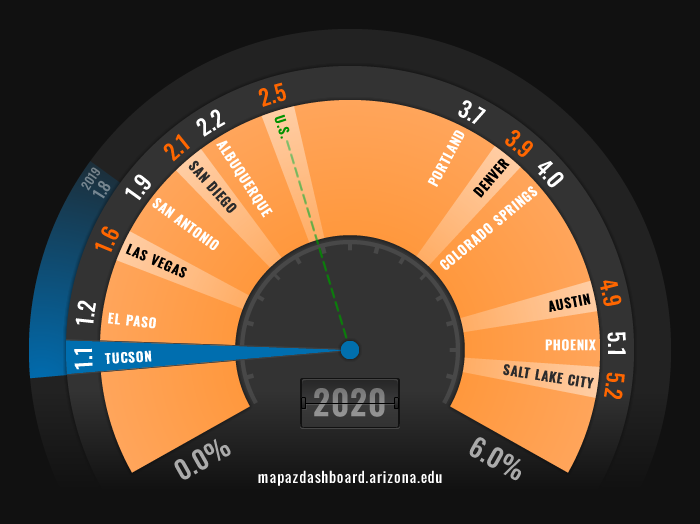

Business Growth Map Az Dashboard

Rate And Code Updates Arizona Department Of Revenue

![]()

Georgia New Car Sales Tax Calculator

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

State And Local Taxes In Arizona Lexology

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero