tax on unrealized gains india

Where there are unrealized gains - no tax is payable as you have not booked any profits. It can potentially become a penalty for being successful according to.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Senators presented similar plan to pay for Build Back Better.

. If you sold the stock before December youd have a short-term realized gain of 10. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. Some of the key points are.

For a long-term however the tax rate would be lower than that of a realized gain. Most assets held for more than one year are taxed at the long-term capital gains. The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition.

A tax on unrealized gains would harm the economy. A 2019 analysis from the left-leaning Center on Budget and Policy Priorities said that capital gains taxes are effectively voluntary to. Janet Yellens proposal for a capital gains tax in US may push global money towards markets like India FII activity between January 2020 to January 2021NSE Business Insider India Flourish India was the best performer amongst the worlds 10 major equity markets in the last 6 months and one of the big reasons is the dramatic spurt in foreign.

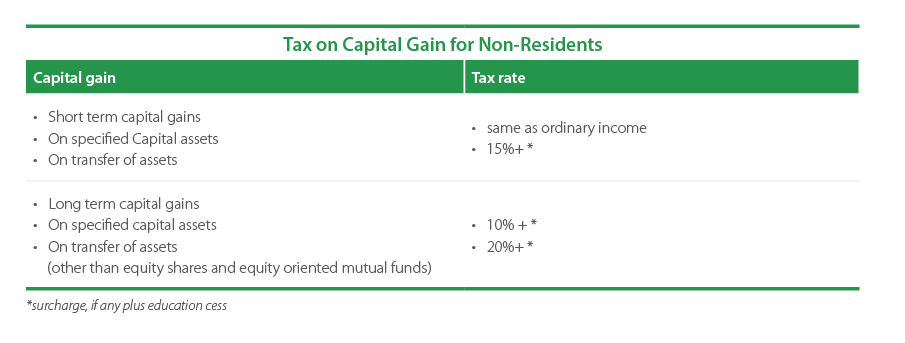

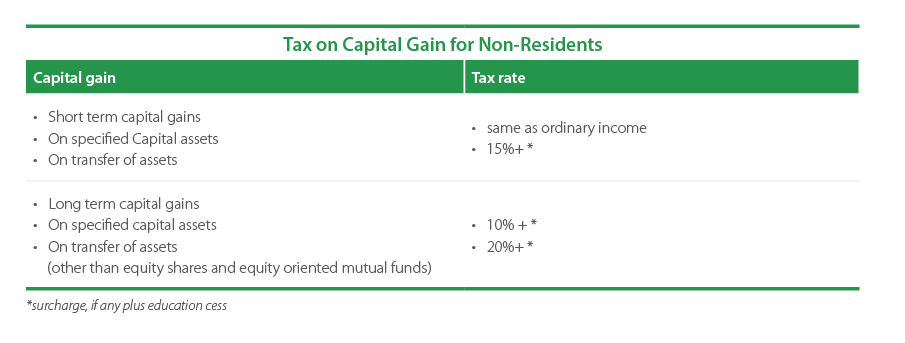

Biden to Propose 20 Tax Aimed at Billionaires Unrealized Gains. If securities transaction tax has been paid for an equity share in a companyunit of an equity-oriented fundunit of a business trust. Capital gains tax in India Important rules to be aware of.

11 hours agoTo fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at. At the time of acquisition and transfer for a long-term capital asset the gains exceeding INR100000 are subject to a tax of 10 excluding surcharge and cess. If you dont sell the share Rs10 is your unrealized gain.

It has no tax implications but just is an indicator to suggest you as where you are moving. Investors may choose to sit on unrealized gains for tax benefits. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains.

Tax Breaks under section 80c to 80U is not available to Capital gain Income. So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same. 1 day agoAfter all someone who bought Bitcoin at its value of about 30000 in July of 2021 would have ended the year with about 17000 in unrealized gains per Bitcoin.

The tax rate on this gain would be the ordinary income-tax rate. The budget proposes that households worth more than 100 million pay at least 20 in taxes on both income and unrealized gains-- the increase in an unsold investments value. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess. Only in case of realized gains do you have to pay taxes in case of a mutual fund. The proposal to tax unrealized capital gains comes at a time when better-off Americans have seen their net worth skyrocket thanks to soaring stock prices and real estate values during the pandemic.

If you sell the share then Rs10 becomes your realized gain which is absolute profit to you and would be taxable. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this. Capital Gains Tax where Securities Transaction Tax is Payable.

If these households realize 6 trillion of their 75 trillion of that gain during. Unrealized gains are not taxed by the IRS. If your Income is comprised of Capital gains that come under a special tax rate you cannot save on tax outgo on the same by Investing in PPF.

This does not affect the application of the STT which must be paid in the usual manner. While the left insists that we must tax unrealized gains to ensure that the wealthy pay their fair share the tax code is already steeply progressive According to the Congressional Budget Office the top 1 percent of earners paid 417 percent of income taxes in 2018 and 259 percent of federal taxes. He estimated that taxpayers subject to our proposal have unrealized gains totaling about 75 trillion in 2022.

Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to. Yellen had first proposed the tax on unrealised capital gains in February 2021. Tax saving us 80C to 80U is not allowed to Capital gains.

Tax could generate 360 billion in new revenue over 10 years. For companies engaged in manufacturing business and opting to pay corporate tax at the lower rate interest income shall be taxable at 2517 including applicable surcharge and education cess. Capital gains are only taxed if they are realized which means you dispose of the asset.

For example if you were ahead of the curve and bought bitcoin for 100 and now its worth 9100 you have an unrealized gain of 9000. Gains exceeding INR 100000 made on sale of listed equities of an Indian company units of an Indian equity oriented fund and units of an Indian business trust would now be subject to a 10 tax. The difference between an unrealized gain and a realized gain depends on when you sold your investment.

This means you dont have to report them on your annual tax return. President Joe Bidens plan to tax unrealized capital gains ran into opposition from key Democratic Senator Joe Manchin likely dooming it just hours after it. Interest income received by a foreign company is taxed at a concessional rate of withholding at 520 subject to conditions.

How To Tax Capital Without Hurting Investment The Economist

Strategies For Investments With Big Embedded Capital Gains

Do You Know What Is The Mutual Fund Taxation For Fy 2020 21 Advisorkhoj

Capital Gains Yield Cgy Formula Calculation Example And Guide

What Is Capital Gain Tax Of Capital Gains In India Fincash

The Unintended Consequences Of Taxing Unrealized Capital Gains

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

Capital Gains Tax In India An Explainer India Briefing News

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Are Unrealized Gains From Stocks Taxable In India Quora

Can Stock Market Losses Be Tax Deductions In India Quora

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

Strategies For Investments With Big Embedded Capital Gains

What Is The Difference Between A Realized Gain And An Unrealized Gain In Investments Quora

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18